If you haven’t heard about The Great Ft. Hood Heist of 2014 read this article before reading this post.

Business actions are like military movements, after every one you should perform an After Action Review. It’s important to figure out what you did well, what you should continue to do, and what you need to change. The reality is, all too often we forget to compile our lessons learned when things go well, because…. well…. they went well. But the reality is, that even when everything works out the way we wanted, we could still have done something better.

An imperfect being can never be perfect, but that shouldn’t stop us from striving towards perfection.

This past week I have been down in Texas dealing with the aftermath of the stealing of thousands of dollars, by a now defunct property management company, from a lot of military and veteran families.

As much as I hate to admit it, I’m one of those families.

But the question remains, what are some lessons that everyone can learn from The Great Ft. Hood Heist of 2014? Besides the fact that Nissan Sentras start to completely lose their composure at 90mph

That’s a top tip from this Top Gear fan.

here are the following lessons:

1) It’s nothing personal, it’s just business.

There’s a reason why this is the first lesson I lead off with. It’s probably one of the most important lessons that anybody can learn about business. Business is business. This lessons doesn’t mean that you can break your word at will

That’s bad for your business in the long run.

or that the best heart is a cold heart in business.

As long as logic tempers the heart.

Rather this means that if somebody breaches a contract with you, steals from you, or lies to you don’t take it personally, because when you take it personally you’ll lose focus on what you need to do: Recoup as much of your losses as possible and gain from them as much repayment as possible.

It’s only human to become angry and begin to hate, but you can't.

2) A rental property is a business, not an investment.

Most people enter into the buying of a rental property as if it is an investment. I admit, when I was 22, I looked at buying this home in Texas, the first property that I ever bought as if I was buying an investment.

For some reason, I felt at the time that I was so far behind all of my friends who had gone to college. I kept on telling myself that I needed to start making moves.

At first glance, this seems like a no-brainer. If I’m not buying a home to live in for the majority of my life, I’m buying a property as an investment. You plan on making money off of the home. Whether that was by renting it for the rest of your life or selling it, your intention was to make money off of the property.

Take note on when I use “home” and “property”. They’re important concepts.

However, unlike an investment, as most people consider renting a property to be, owning a property and renting it is in fact a business from which you hope to make money.

So why do I harp on this difference? Simply put, when most people talk about investments they think of mutual funds, 401Ks, the type of securities that require a very minimal amount of work but which produce, or rather hopefully produce, increases in value over time. Owning and renting a property is something much different. Your property requires upkeep. Your tenants are living people who you need to ensure are both taking care of your property and are being taken care of by you or your property manager. Making money off of renting your property requires activity and work on your part.

There’s a reason why properties have a “salvage value”. If you don’t know the term look it up, because Concepts is a lesson that is coming up next.

3) You’re in business for yourself, so learn business.

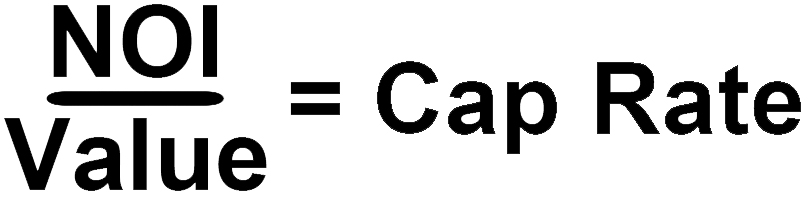

What’s a sole proprietorship? What does it mean to buy a company? Is an owner of a LLC liable? These are concepts, business practices, which are important for you to know. The minute that you buy a property with the intention to make money off of that property you are now in business for yourself. This does not mean that you have to learn to seasonalize data, create sensitivity analysis, or know the CAP Rate formula.

Although if you are buying a property to rent, you really should know what the CAP Rate formula is.

However, this does mean that you need to pick up a business book, or a business for dummies book and learn from it. Don’t be the sucker who got into business, because you will come out on the short end of business deals.

“There’s a sucker born every minute” ~ David Hannum.

Remember, business is business, it’s not personal.

4) Your rainy day fund is for a rainy day, not for your property.

Your rainy day fund is for you. It’s for when your car breaks down. It’s for when your kid needs to go to the emergency room. It is not for an investment property. Most lawyers and those in business will warn you of the dangers of comingling funds from your personal and business life. Unfortunately it’s easy when the proceeds from your rental property are going into your normal checking account to forget that this money isn't from you normal 9-5 job. In accounting there is the idea of Retained Earnings. Retained Earnings are profits that you take from one year to the next. While not getting into too much detail, many companies keep a percentage of what it would take to prop up their company during a down time.

Vacancy Rate is a term you have to know.

Since there are only two types of down times when renting a single unit investment property; 1) the need to fix things that break 2) vacancy of property, it is incredibly important for you to maintain an account for your property that could pay for 1.5 times the vacancy rate in your market.

More or less, based on your own comfort level.

5) Realize that you might lose money

People still get into real estate because they believe that they are going to make money. Like anything in life, trying to make money off of an investment property is a risk. Too many military and veteran families count on the monthly rental income as a large source of their Gross Income.

Much different than Net Income.

The greater the risk, the greater the reward. We often pay more attention to the reward part than the risk part. The one thing that many honest businessmen and women will tell you is that they, we, have learned much more from our mistakes than from our successes. Sometimes you pay for your mistakes. Other times you don’t make as much money as you could have made. Either way, what is as important in business as in life is that you continue to learn and improve yourself.

For anybody who was caught up in The Great Ft. Hood Heist of 2014, or for anybody who is considering getting into real estate, make sure to learn from what has happened.

Want to keep up to date with The Inveterate Veteran? Make sure to become an Inveterate below and to like us on Facebook.